EVINCE UHUREBOR examines the growing controversy and concerns trailing Nigeria’s newly enacted tax reform laws

S ome political stakeholders, civil society groups, and concerned citizens have called for the suspension of the newly enacted tax laws, arguing that the gazetted laws did not reflect what lawmakers debated and approved. President Bola Tinubu had on June 26 signed into law a historic package of tax reform legislation, marking the most comprehensive overhaul of Nigeria’s fiscal architecture in decades.

The four Acts – Nigeria Tax Act, Nigeria Revenue Service (Establishment) Act, Nigeria Tax Administration Act and the Joint Revenue Board (Establishment) Act, seek to streamline revenue administration, enhance compliance, strengthen intergovernmental coordination, and reposition the tax system to support inclusive growth.

The Acts, however, triggered a widespread debate when a member of the House of Representatives, Abdussamad Dasuki, alleged discrepancies between the tax laws passed by the National Assembly and the versions gazetted and released to the public. Dasuki, who made the allegations during plenary, insisted that the content of the gazetted tax laws did not reflect what members debated, voted on, and passed.

He urged the speaker of the House of Representatives, Tajudeen Abbas, to ensure that all relevant documents, including the harmonised versions, votes, and proceedings of both chambers, were brought before the committee of the whole for scrutiny by all members. Responding, the speaker, underscored the seriousness of the allegations by announcing a seven-man ad hoc committee to investigate the claim.

The committee has Muktar Betara as chairman. Other notable members include Idris Wase, Sada Soli, James Faleke, Fred Agbedi, Babajimi Benson and Iduma Igariwey. The chairman of the Presidential Fiscal Policy and Tax Reforms Committee, Taiwo Oyedele, however insisted that claims of discrepancies could not be verified without access to the officially certified versions of the bills passed by lawmakers. He noted that even members of the executive arm, including himself, only had access to the versions presented to President Tinubu for assent.

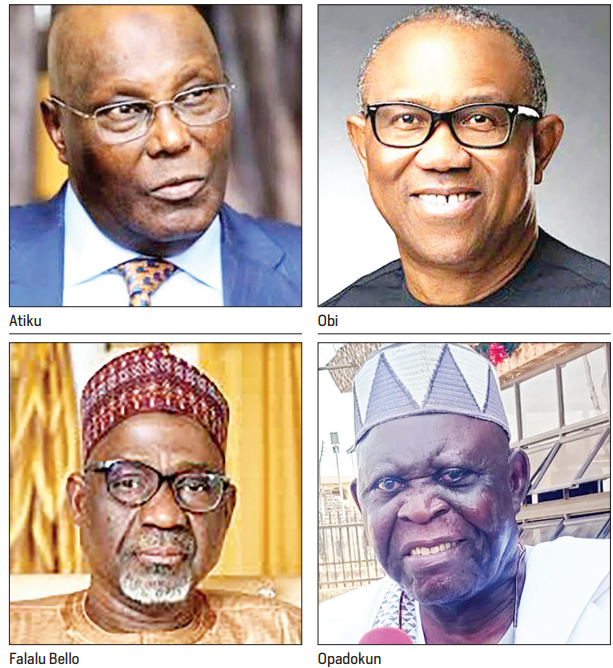

Atiku, Obi condemn discrepancy

However, the tax law which is scheduled to take effect on January 1, 2026, has continued to trail widespread debate and reactions among political parties, civil society groups, and prominent political figures, including former Vice President Atiku Abubakar and Labour Party presidential candidate, Peter Obi.

In his reaction, Atiku described the modifications of the tax reform as “an act of treason against the Nigerian people,” accusing the executive branch of undermining legislative supremacy and stripping citizens of fundamental due process protections.

He argued that the introduction of mandatory 20 per cent security deposits for tax appeals, compound interest on tax debts, forced USD computation for petroleum operations, and other measures that he said increase financial burdens on citizens while removing key accountability mechanisms.

Obi, on his part, described the development as a dangerous escalation from poor governance to outright abuse of the law. He described the alleged alteration as not merely an administrative oversight but “a serious matter that strikes at the core of constitutional governance and reveals the extent of our institutional decay.”

The former Anambra State governor further lamented that we have transitioned from a Nigeria where budgets are padded to one where laws are forged, changes that impact taxpayers’ rights and, most importantly, access to justice. “Even more alarming is the introduction of new enforcement and coercive powers tha t the House of Representatives never approved”

ADC, PDP, PRP demand suspension

Reacting to the development, the African Democratic Congress (ADC) called for the immediate suspension of the tax laws, alleging that critical sections were modified after approval by the National Assembly and assent by President Tinubu, a development the party described as a grave constitutional breach.

In a statement issued by its National Publicity Secretary, Bolaji Abdullahi, the party warned that altering legislation after approval by the legislature raises concerns that President Tinubu is allegedly seeking to centralise power. The opposition party demanded an immediate halt to the implementation of the tax laws to enable the National Assembly to review the alleged alterations and take appropriate corrective action.

The Peoples Redemption Party, on its part, described the development as a dangerous pattern of executive impunity that undermines the rule of law, separation of powers, and democratic accountability. According to the National Chairman of the party, Falalu Bello, the party warned that the allegations raised by a member of the House of Representatives suggested that substantive clauses were inserted, removed, or modified without legislative approval.

“This is an unforgivable breach of trust and a direct assault on the integrity of our legislative process,” the party said, warning that such actions could erode public confidence and expose the country to instability. In its reaction, the PDP commended Dasuki “for his fastidiousness and courage in the discharge of his legislative duties.” It demanded “that the commencement date of the Tax Act be shifted from January 1, 2026, for at least six months to allow sufficient time for the investigation of this anomaly.

Civil society groups fumes

The National Opposition Movement, on its part, demanded the immediate suspension of the tax plan’s implementation, warning that forcing it through would worsen the living conditions of Nigerians. Addressing a press conference at the Yar’Adua Centre, Abuja, the NOM spokesperson, Chille Igbawua, said Nigerians are already struggling with poverty, unemployment and rising living costs, insisting the new tax regime would be punitive. According to him, the combination of fuel subsidy removal, naira depreciation, food inflation and rising electricity tariffs will pushed households and small businesses to the brink.

“What the government is rolling out in January is not a tax reform; it is an assault on the livelihood of ordinary Nigerians,” he said, alleging that low-income earners and the unemployed would be disproportionately affected. Also speaking on the development, the Socio-Economic Rights and Accountability group (SERAP), urged President Tinubu to urgently direct the Attorney General of the Federation and Minister of Justice, Lateef Fagbemi (SAN), to clarify whether the versions of the tax bills received from the National Assembly are identical to the versions signed into law and ultimately gazetted. SERAP also requested the publication of certified true copies of the versions of the laws eventually gazetted.

The documents requested include the National Revenue Service (Establishment) Act; the Joint Revenue Board of Nigeria (Establishment) Act; the Nigeria Tax Administration Act; and the Nigeria Tax Act. The organisation further urged the President to direct the Attorney General to clarify whether the versions of the tax bills received from the National Assembly are identical to the versions signed into law and ultimately gazetted.

Northern groups reject legislation

The Arewa Youth Assembly in a state ment by Mohammed Salihu-Danlami, described the situation as “governance by ambush” and warned of serious political consequences if not addressed.

He said any law presented to the public must reflect what was debated and passed by elected representatives, adding that the alleged discrepancies constituted a constitutional crisis. His words: “If the law presented to the public is not the same law debated and passed by elected representatives, then democracy itself is being subverted. Legislation is not a private document; it is the collective will of the people.”

The League of Northern Democrats, on its part, called on the National Assembly to commence impeachment proceedings against President Tinubu if allegations of alterations to the tax laws are proven. In a letter addressed to the President of the Senate, Godswill Akpabio and Speaker Abbas, the group said the alleged alterations, if confirmed, would amount to a violation of the constitution.

The letter, titled “Re-alleged Alteration of a Duly Passed Tax Law and Your Constitutional Duty to Act,” was signed by the group’s Publicity Secretary, Ladan Salihu. The group said the President had no constitutional authority to amend or rewrite a bill passed by the National Assembly, noting that such action would constitute gross misconduct under section 143 of the Constitution. It warned that failure by the National Assembly to act decisively could undermine constitutional democracy and reduce the legislature to a subordinate arm of the executive.

Support for tax reforms

In contrast, the chairman of the Ondo State Internal Revenue Service, Adebayo Rojugbokan, urged Nigerians to support the tax reforms, saying they would benefit economic development.

Speaking at an end-of-year event organised by the Akure Bankers’ Committee, Rojugbokan said there was no need for fear, describing the reforms as a modernisation of Nigeria’s tax system. He said the reforms would reduce the number of taxes and enhance transparency and accountability. “Tax reform is just a way of modernising our taxation.

It is a right of the people, and it can mean that individuals will reduce the number of taxes in Nigeria in 2026. A chieftain of the National Democratic Coalition (NADECO), Ayo Opadokun, praised Tinubu for what he described as a bold and historic tax reform steering Nigeria toward fiscal federalism. He said for the first time in our recent history, Nigeria is being deliberately led towards the path of fiscal federalism.

The new tax regime commencing on January 1, 2026, is a bold and necessary move that deserves commendation. Opadokun added that by strengthening revenue generation and accountability at the sub-national level, the reforms have the potential to deepen development, reduce overdependence on the centre and restore balance to Nigeria’s federal structure.

Assessing the state of the nation as of December 2025, Opadokun said the Tinubu administration had embarked on far-reaching economic reforms aimed at addressing long-standing structural weaknesses in the economy. He said Nigeria stands at a critical point in its historical journey.

The present administration has shown the courage to confront difficult national realities, particularly in the economic sphere, that previous governments often postponed. However, the NADECO chieftain cautioned that positive macroeconomic indicators would remain meaningless unless they translated into tangible improvements in the lives of ordinary Nigerians.