…mergers, acquisitions beckon

Following President Bola Tinubu’s assent to the Nigerian Insurance Industry Reform Act (NIIRA), the sector regulator, the National Insurance Commission (NAICOM), is expected to put modalities in place soon to increase the capital thresholds of operators based on the new law.

The industry, according to experts, has been largely undercapitalised, and efforts to increase the capital base by the immediate past Commissioners for Insurance were resisted by the operators, some of whom argued that insurance, unlike banks, did not require too much capital to operate as a business.

However, based on the current dispensation, the operators have no choice than to ship into the system by increasing their capital requirements to a total of N680 billion from N145 billion, which is the current operating capital base of the entire industry.

The figure, which represents 368.97 per cent increase, covers the 46 frontline operators that are currently active in the inndustry. This figure excludes micro insurance and takaful operators.

According to the new Act, operators, who are into General business, are expected to increase their capital from the N3 billion, which they are operating with at the moment to N15 billion, those in Life business from N2 billion to N10 billion while reinsurers are expected to boost their capital from N10 billion to N35 billion.

At the moment, there are 29 General business operators, 14 Life operators, two reinsurers, 12 micro insurance operators and five takaful businesses.

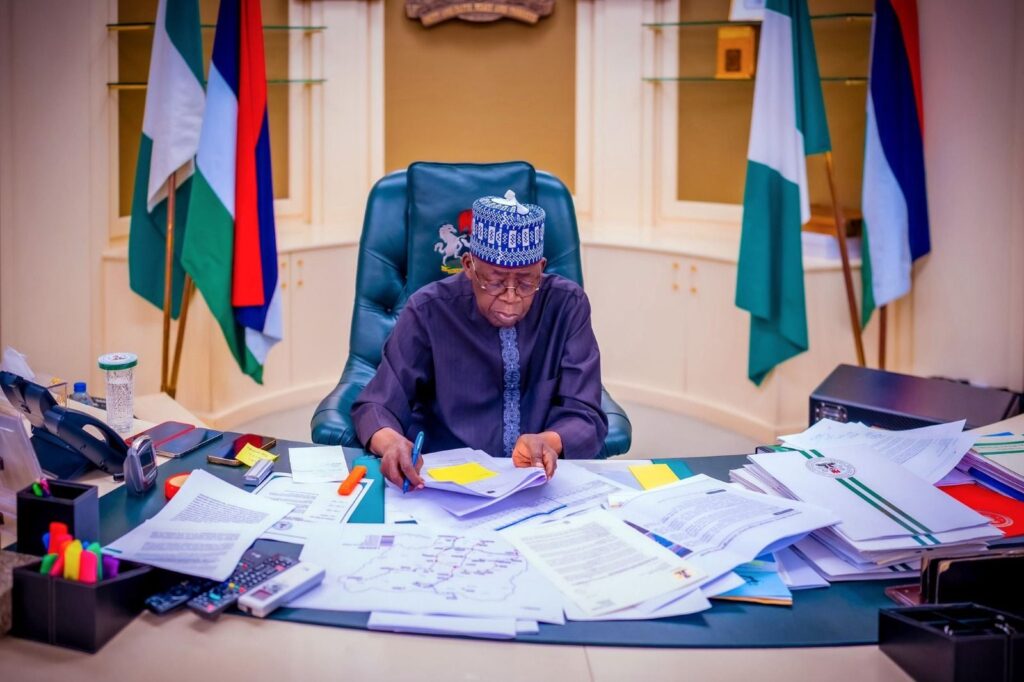

On signing the Act, the Presidency directed NAICOM to administer and implement the provisions of the NIIRA 2025 in a manner that unlocks the industry’s full potential and significantly improves insurance penetration across the country.

According to a statement, “this development reaffirms the administration’s commitment to financial stability, economic development, and inclusive growth.

“The NIIRA Act 2025 ushers in a new era of transparency, innovation, and global competitiveness for the insurance industry.”

Apart from the new law enabling the operators to play big in the country, it is also expected to play a big role in Federal Government’s targeted $1trillion economy.

Recall that as far back as 2019, NAICOM, under Mohammed Kyari as Commissioner for Insurance, had unveiled a new operational capital structure for the operators.

The exercise, which was supposed to have ended on December 31, 2020, was tactically resisted by the operators until it fizzled out.

Kyari had announced an increase in the minimum operating capital of operating firms under the tier-based capital regime that graded the industry’s capital into tier one, tier two and tier three.

This attempt faced resistance from operators and some minority shareholders, whom the insurers usually deploy as proxies to speak against such exercise and in some cases take the matter to court since they cannot come out openly to kick against their regulator’s policies and recommendations.

Another attempt to recapitalize the industry was during the immediate past Commissioner for Insurance, Mr. Sunday Thomas.

The regulator reviewed minimum paid–up capital share of Life Insurance business from N2 billion to N8 billion.

General Insurance business was raised from N3 billion to N10 billion, Composite business was raised from N5 billion to N18 billion and Reinsurance business was raised from N10 billion to 20 billion.