The Managing Director/Chief Executive Officer of Arthur Stevens Asset Management Limited, Olatunde Amolegbe, has stated that despite the hardship facing Nigerians due to recent economic reforms, the country’s capital market has remained one of the most consistent bright spots under the current administration.

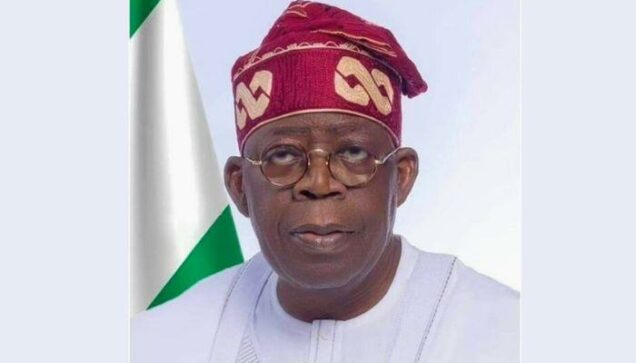

Speaking in an interview with our correspondent on Sunday, assessing President Bola Tinubu’s two years in office, Amolegbe noted that while some of the reforms introduced may appear harsh and fast-paced, they were necessary to prevent total economic collapse.

“It has been two years of aggressive reform of the economy through various policy changes that some will call bold and others will call overly aggressive. The president has acted like we are running out of time as a country, and all the medicine needed to be taken at once to save our economic lives,” he said.

Amolegbe acknowledged that some analysts have called for a more sequenced and gradual approach. Still, he argued that “no one is disputing that the changes he has implemented are not necessary if you look critically at where we are coming from as a country. It’s clear the economy was on life support and on the brink of collapse before he came in.”

He pointed to several key reforms, including the floating of the naira, removal of fuel and electricity subsidies, and comprehensive tax reforms, as instrumental in boosting investor confidence. These moves, he said, have helped shore up government finances and rejuvenate market activity.

“Policies such as the floating of the naira, removal of fuel and electricity subsidies, and efforts at comprehensive tax reforms were read as positively accretive to the finances of the country, and the stock market responded positively,” he noted.

According to him, the Nigerian Exchange’s All Share Index, the benchmark indicator for stock market performance, has gained over 40 per cent in the last two years.

“We have also seen a significant return of foreign portfolio investors to our market in the last two years, and more companies are approaching the market to raise capital,” Amolegbe said.

He highlighted the Central Bank of Nigeria’s recapitalisation directive for banks as a key liquidity booster, deepening the market and creating renewed interest in equities.

In addition, Amolegbe noted the federal government’s increasing presence in the local fixed-income market through bond issuances to bridge infrastructural and budget deficits. “Nigeria issued its first US Dollar Domestic Bond and also issued its first Eurobond in over 10 years,” he added.

He commended the President for recently signing the new Investment and Securities Act into law, noting that it “could really revolutionise our capital markets in the next few years.”

However, Amolegbe maintained that more could still be done to consolidate the gains made so far, especially in areas that directly affect businesses and households.

“For instance, the pace of privatisation and commercialisation of non-performing public assets could be increased significantly to unlock their value,” he said. “Also, efforts to lower the operational and finance costs of companies operating within the economy need to be placed at the front burner in order to increase production and reduce unemployment.”

He stressed the need to urgently address the challenges of electricity supply and insecurity, which continue to hamper food production and manufacturing.

While acknowledging the positive indicators in the capital market, Amolegbe also recognised the painful economic realities Nigerians are enduring.

“The fact is that these reforms, while necessary, have involved the citizenry having to bear significant pains, such as the ongoing cost-of-living crisis. Therefore, the government should continue efforts at easing those challenges as the reforms work their way through the system to achieve the needed objectives,” he concluded.