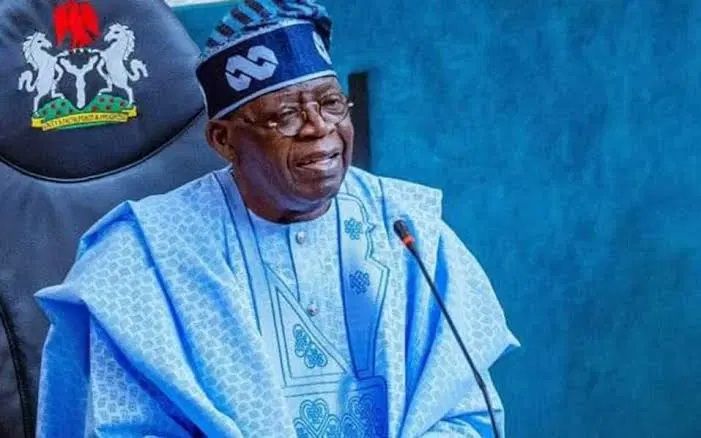

The international monetary order is undergoing historic shifts. As Western dominance, symbolized by the U.S. dollar, comes under pressure from emerging powers, the BRICS coalition—Brazil, Russia, India, China, and South Africa—has emerged as a rival force advocating a multipolar world. At the 17th BRICS Summit held recently in Brazil, President Bola Tinubu reaffirmed Nigeria’s support for “a new global financial order.” His comments sparked national debate: Should Nigeria join BRICS? What would such a move mean for our economy, sovereignty, and future? The answers require not rhetoric but sober analysis rooted in economic fundamentals, historical insight, and strategic foresight.

BRICS represents an ambitious attempt to break Western dominance over global finance and development. The bloc’s goals include: De-dollarization: Promoting trade in local currencies, thereby reducing dependency on the U.S. dollar. Alternative development finance: Through the BRICS New Development Bank (NDB), offering loans without the IMF/World Bank’s usual political strings. South-South cooperation: Deepening collaboration among developing nations and expanding their global influence.

What does this mean for Africa? BRICS offers African countries, including Nigeria, access to new trade routes, diversified funding sources, and more influence in global affairs. Countries like Egypt, Ethiopia, and Algeria are already leaning in. However, as President Tinubu rightly observed, aligning with BRICS must not come at the expense of African unity or without due diligence.

It holds some potential gains for Nigeria. This includes currency diversification as trading in local currencies (Naira, Yuan, Rupee) could reduce dollar demand. Infrastructure Finance: Loans for power, transport, and industrialization from BRICS NDB. Export Expansion: New non-oil export markets, especially in China and India. Geopolitical Leverage: A stronger voice in global south alliances.

But there are risks: Western retaliation: U.S. President Donald Trump and others have threatened trade sanctions on BRICS nations. Ideological Tensions: BRICS includes authoritarian states like Russia and China. Nigeria, as a democracy, must tread carefully. Dependency Shift: Trading Western dependency for Chinese or Russian dominance isn’t progress.

Should Nigeria Join BRICS?

Nigeria has the population (over 220 million), a strategic location, and significant natural resources—but it also has structural weaknesses: heavy dependence on oil, weak currency, poor infrastructure, and over 40 per cent of its foreign debt in dollars.

Why BRICS may help. It will ensure Dollar Pressure Relief: Participating in non-dollar trade could ease exchange rate volatility and reduce demand pressure on the Naira. Next to this is Access to Development Funds: The BRICS bank offers lower-interest loans potentially free of IMF-style austerity. Export Market Diversification: With economies like China, India, and Brazil needing raw materials, Nigeria can diversify away from oil.

Of great importance us Global South Leadership: Nigeria could shape Africa’s voice in global economic negotiations if it takes a leadership role in BRICS-Africa relations.

But here’s the catch: Without internal reforms, these benefits will remain aspirational. President Tinubu has rightly called for more African participation in global rulemaking, but Nigeria must be ready to lead from a position of economic strength, not desperation.

The Backlash: Trump’s Tariff Threat and Investor Jitters. President Donald Trump’s imposition of tariffs on BRICS members—especially those expanding ties—must be taken seriously. Nigeria’s largest non-oil export market is still the West. Any trade or financial penalty from the U.S. or EU could undercut gains from BRICS

Other key risks are loss of Western Market Access. Nigeria’s textile, agricultural, and tech exports could suffer. There is also investor flight: Perception of anti-West alignment could trigger capital flight or reduce Foreign Direct Investment (FDI). Diplomatic Friction: Nigeria could lose influence in institutions like the UN, IMF, and World Bank.

Tinubu’s role must be that of a strategic balancer—not a cheerleader. Nigeria must define its national interest clearly and pursue partnerships with both East and West.

What must Nigeria do to truly benefit from BRICS? Joining BRICS is not a magic wand. If poorly prepared, Nigeria risks becoming a pawn between global powers. Here’s what must happen:

Stabilize the Currency: Strengthen the Central Bank’s independence, adopt inflation-targeting, and deepen forex reserves. Institutional Reforms: Combat corruption, ensure rule of law, and enforce contract transparency—especially in public finance.

National Consensus Building: Educate lawmakers, business leaders, and citizens about BRICS goals and implications. Balanced Foreign Policy: Avoid “bloc politics.” Maintain strong ties with the West while expanding cooperation with BRICS. Pan-African Collaboration: Nigeria should lead ECOWAS and AU in developing a common BRICS-Africa negotiation framework.

The U.S. Dollar: From Bretton Woods to Global Supremacy

To understand why BRICS is pushing for de-dollarization, we must revisit how the U.S. Dollar came to dominate: Bretton Woods (1944): After WWII, global currencies were pegged to the U.S. dollar, which was backed by gold. The Nixon Shock (1971): President Nixon ended the gold standard. The dollar floated, but confidence in U.S. institutions kept it king.

The Petrodollar System: In the 1970s, oil-producing nations agreed to sell oil in dollars, guaranteeing demand. This system entrenched the dollar as the world’s default currency. Today: Over 80% of global trade and over 60% of global reserves are still dollar-based. This dominance gives the U.S. leverage through sanctions, debt control, and trade policy—one of the very tools BRICS seeks to neutralize.

Dollar Standardization for Africa and Nigeria has some benefits. Global Trade Convenience. The dollar is universally accepted, simplifying imports and exports. Reserve Strength: Holding dollars shields Nigeria during crises. Access to Global Finance: Most loans and aid programs are dollar-denominated.

But there are some downsides including exchange rate vulnerability. When the Dollar strengthens, the Naira weakens—fueling inflation and hurting the poor. Foreign Debt Burden: Over 40 per cent of Nigeria’s debt is dollar-based. A weak Naira means paying more. Policy Constraints: Nigeria’s monetary sovereignty is compromised when too tied to the dollar system. This is the chokehold BRICS wants to break—but it cannot happen overnight or without structural transformation at home.

President Tinubu’s ambition to align Nigeria with BRICS reflects bold leadership in an evolving global landscape. But boldness without preparation is perilous. Nigeria must pursue a pragmatic path: strengthen internal institutions, negotiate from a position of strength, and avoid ideological entrapment. The global monetary system is indeed shifting—but Nigeria’s success will not come from choosing sides, but from choosing strategy. Nigeria should not rush into BRICS. It must prepare, negotiate, and lead on its own terms.

· Aliu writes from Ibada, Oyo State