Moniepoint Inc. has revealed that its microfinance bank disbursed over N1tn in credit to thousands of businesses, from provision stores and supermarkets to building materials sellers, in 2025.

This was disclosed in its 2025 Year in Review published on Thursday.

The PUNCH reports that in 2025, Moniepoint Inc. achieved unicorn status with the successful completion of its Series C funding round, which raised over $200m in equity financing from leading institutional investors, including Development Partners International, Google’s Africa Investment Fund, Visa, the International Finance Corporation, and Verod Capital.

On the funding of businesses, Moniepoint claimed that on average, the small businesses that benefited from its credit facilities experienced growth by more than 36 per cent after accessing credit, signposting its primacy as a transformational growth lever and instrument for deepening shared prosperity.

The fintech outfit added that it uses alternative data points that include transaction histories, business patterns and payment behaviours in a bid to accommodate what traditional credit scoring misses to drive financial inclusion and access to credit.

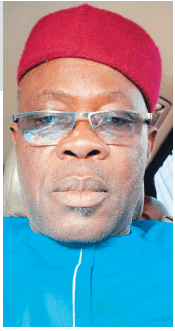

Commenting on the company’s achievements in 10 years of operations, Group Chief Executive Officer and Founder of Moniepoint Inc., Tosin Eniolorunda, said, “Our journey has been one of intentional evolution. What started as a passion to solve overlooked problems has evolved into a platform powering the dreams of millions.

“As 83 per cent of employment in Africa exists in the informal economy, our mission to create financial happiness is an operational mandate that guides our product development, our market expansion, and our capital allocation decisions.”

Beaming with enthusiasm, Eniolorunda added, “Yet for all we have accomplished, we approach our second decade with the clarity that our work remains unfinished. As we enter this next chapter, we do so with strengthened conviction in our strategy, deepened partnerships with world-class institutional investors, and an organisation scaled to deliver on Africa’s entrepreneurial potential. The infrastructure we have built over the past decade provides the foundation. The journey is far from over, but our resolve has never been stronger. To our partners, our customers, and our team: thank you for a decade of impact. We are just getting started.”

Moniepoint Inc. was founded in 2015 by Tosin Eniolorunda and Felix Ike. It was formerly known as TeamApt Inc.

During the year, as Nigeria’s largest merchant acquirer, now powering eight out of every 10 in-person payments made across the country, Moniepoint MFB, the banking and payments subsidiary, processed N412tn in transaction value, handling more than 14 billion transactions. This clearly suggests that Moniepoint is well-positioned to play a greater role in Nigeria’s steady march towards a trillion-dollar economy by 2030.

In 2025, the firm also marked the launch of MonieWorld in the United Kingdom, extending Moniepoint’s platform to serve the African diaspora by strengthening key remittance corridors and laying the foundation for the delivery of comprehensive cross-border financial services.

Moniepoint MFB relaunched its savings product to meet the needs of customers. The firm said the launch of Moniebook and the acquisition of a national microfinance bank licence for Moniepoint MFB further expand the company’s regulated capabilities and product depth.

TeamApt Ltd, the switching and processing subsidiary of Moniepoint Inc., also achieved major regulatory and operational milestones in 2025 that have solidified its position in the global payments landscape. After a rigorous certification process, the company successfully secured licences from Mastercard and Visa to act as a processor and acquirer for these global card schemes.

“This strategic move allows TeamApt to support international card payments directly and offer these critical switching services to other businesses across the continent. Moniepoint Inc., the web payment gateway, processed N25tn in the period under review, demonstrating remarkable resilience and industry confidence, firmly positioning it for more business-to-business transactions,” said Moniepoint Inc.