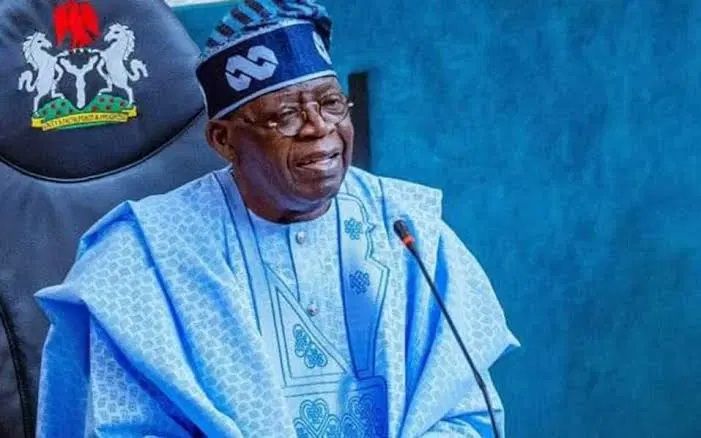

The African Democratic Congress (ADC) has accused President Bola Tinubu of plunging Nigeria deeper into debt, alleging that his administration has borrowed over ten times more than his predecessor, Muhammadu Buhari, within the same timeframe.

In a statement issued by its interim National Publicity Secretary, Mallam Bolaji Abdullahi, the party said while the Buhari administration borrowed an average of ₦4.7 trillion annually, Tinubu’s government is borrowing at an alarming rate of ₦49.8 trillion per year.

“In just two years, this administration has borrowed more than ten times what Buhari borrowed in the same timeframe,” ADC said.

The party warned that if the borrowing trend continues, Nigeria’s total public debt may reach ₦200 trillion before the end of 2025.

“We are speeding toward a financial cliff, and those in charge seem to have no brakes, thinking they can borrow their way out of economic problems that require more thoughtful actions and greater fiscal discipline,” the statement read.

ADC dismissed claims by supporters of the All Progressives Congress (APC) that Tinubu’s borrowings are lower in dollar terms, arguing that the exchange rate renders that point moot. It noted that while Buhari borrowed $4.15 billion annually and Tinubu $1.7 billion, the collapsing value of the naira means the current loans cost far more in real terms.

“With the naira now in free fall due to Tinubu’s poor policy choices, these same loans are costing the country far more. When converted, Tinubu’s foreign borrowing amounts to ₦25.5 trillion every year, compared to Buhari’s ₦2.2 trillion annual average,” it stated.

According to the ADC, the debt situation reflects worsening economic mismanagement and a spiraling currency crisis.

The party lamented that since the APC took power in 2015, Nigeria’s total public debt has ballooned from ₦12.6 trillion to over ₦149 trillion in 2025, with over $35 billion borrowed externally in just 10 years. It claimed the country’s debt to the World Bank has tripled, Eurobond obligations have grown elevenfold, and foreign debt now stands at $67 billion.

The ADC accused the Tinubu administration of reckless borrowing without clear repayment plans or evidence of productive use. It noted that despite rising debts, infrastructure remains poor, universities underfunded, hospitals ill-equipped, and electricity unreliable.

“This is the question Nigerians expect the National Assembly to ask,” the party said. “Instead, it has continued to approve these loans without asking the hard questions, without demanding a plan, and without standing up for the Nigerian people.”

The party cited concerns raised by the Association of Small Business Owners of Nigeria, warning that Tinubu’s borrowings are stifling the economy. It said small businesses can no longer access credit, investors are pulling out, and with over 60 percent of national revenue now servicing debt, the government is overburdening Nigerian families with excessive taxes.

ADC also criticized the government’s justification of external loans, arguing that the recent naira devaluation should have reduced reliance on foreign borrowing. Instead, it said, the government has used the devaluation as an excuse to borrow more.

The party demanded full disclosure of all loan agreements signed over the past decade, including terms, interest rates, repayment timelines, and beneficiaries. It urged President Tinubu to end what it described as fiscal recklessness and focus on meaningful reforms that emphasize prudent spending and productive investment.

“The era of borrowing to cover policy failures must come to an end,” the party concluded.