From the corridors of power to corporate boardrooms, one thing is clear: the Federal Government is making a major bet on private capital to close Nigeria’s N2.3tn vast infrastructure gap, DAMILOLA AINA writes

The Nigeria Public-Private Partnership Summit 2025, held in Abuja, provided a high-level platform for dialogue, dealmaking, and policy commitments as government officials, private investors, and global development partners converged to chart a new path for infrastructure financing.

From heavyweight private investors and industrial giants to global financiers and development institutions, Abuja became a magnet for dealmakers last month as the Nigeria Public-Private Partnership Summit 2025 took centre stage. Held in the heart of the Federal Capital Territory, the high-stakes summit brought together capital and policy in a powerful mix, serving as both a deal room and an idea exchange where boardroom ambition met bureaucratic resolve.

With Nigeria’s infrastructure deficit ballooning, the mission was clear: mobilise private capital through strategic partnerships to deliver critical assets, roads, power, ports, and digital systems. Public funds alone are no longer enough, and the resounding message from the summit was that only bold, reform-driven collaborations can unlock the scale of investment needed to power Nigeria’s next phase of development.

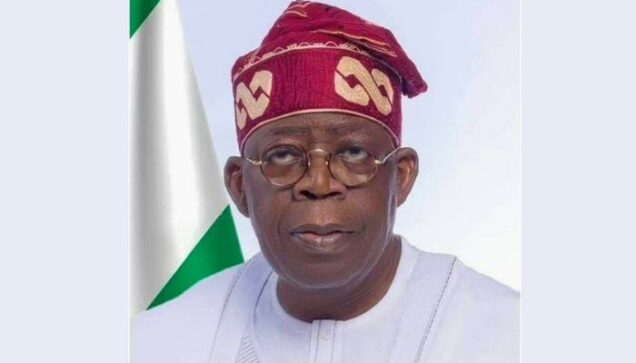

This resolve became clearly evident when the ICRC Director-General, Jobson Ewalefoh, announced to attendees, including President Bola Tinubu, that the country’s infrastructure deficit would require a staggering $2.3 tn to bridge, adding that the scale of Nigeria’s infrastructure deficit offers one of the most compelling investment opportunities on the continent.

“Nigeria is open for business and, more importantly, ready for partnership. With over 200 million people, a growing middle class, rich natural endowments, and an enormous infrastructure gap estimated at over $2.3tn, the case for PPPs in Nigeria is not only compelling, it is urgent,” the ICRC boss declared.

The Abuja conference themed ‘Unlocking Nigeria’s Potential: The Role of Public-Private Partnerships in Delivering the Renewed Hope Agenda’ brought together policymakers, regulators, investors, financiers, development experts, and key stakeholders within and outside the country who engaged in critical dialogue on the future of PPPs in Nigeria’s infrastructure development landscape. It aims to co-create new frameworks, de-risk bankable projects, and strengthen our institutional alignment toward project delivery.

The ICRC DG, speaking in his opening remark, described the summit as more than just a meeting of stakeholders but “a rallying call for transformation, a platform for strategic convergence, and a bridge between national aspirations and tangible development.”

He called on private investors, both local and international, to seize emerging opportunities in Nigeria’s infrastructure sector, declaring the country “open for business and ready for partnership”.

He said the Tinubu administration had taken bold steps to position infrastructure development at the core of its Renewed Hope Agenda, leveraging PPPs as a tool for inclusive growth, innovation, and accountability.

“Under your Renewed Hope Agenda, Nigeria has witnessed a bold recalibration of public policy, prioritising infrastructure as the engine of inclusive growth. Your administration has demonstrated uncommon courage in embracing Public-Private Partnerships, not merely as a funding mechanism but as a governance model that rewards innovation, efficiency, and accountability,” he added.

He further explained that the PPP summit was designed to bring together stakeholders from the public sector, private investors, development partners, and civil society to co-create new frameworks, de-risk bankable projects, and improve institutional capacity for project delivery. Jobson also pledged the commission’s commitment to aligning regulation with facilitation and ensuring that every PPP transaction is not only legally sound but also economically viable and socially impactful.

“At the ICRC, we are aligning regulation with facilitation and compliance with collaboration. We are committed to ensuring that every PPP transaction is not just legally sound but economically viable and socially impactful,” he said.

He cited projects such as the Highway Development and Management Initiative, the MediPool medical infrastructure initiative, Ikere Gorge Dam, Borokiri Fishing Terminal, and the MEMS platform as evidence of this new PPP-driven approach.

But the challenge remains: how will Nigeria transition from lofty infrastructure pronouncements to concrete reforms that close its yawning infrastructure gap? The real challenge lies in moving from promises to performance, from bold speeches to functional roads, smarter border management systems, seamless private sector participation, and digital governance frameworks that de-risk investment and inspire lasting investor confidence.

Closing the gap will require more than vision; it demands consistent execution, regulatory clarity, and a firm commitment to Public-Private Partnerships as the engine of delivery.

In his keynote address and while declaring the event open, President Tinubu said the reforms are designed to diversify the nation’s economy, reduce over-reliance on oil revenues, and attract foreign investments.

Represented by Vice President Kashim Shettima, he highlighted additional reform measures, including the optimisation of government revenues, the streamlining of bureaucratic processes, and efforts to enhance transparency in project pipelines.

According to the president, these reforms aim to create a stable and attractive environment for investors, aligning with global best practices.

“The old model of public-only infrastructure funding is no longer sustainable,” he noted, adding, “Our national aspirations far exceed what public budgets alone can deliver.” That is why we must innovate and why we must work together. We are not looking for investors to carry burdens. We are offering opportunities to create value. We seek long-term partners who are ready to help us bridge our infrastructure gap with purpose and precision.”

The President noted major progress since 2023, emphasising reforms like ICRC strengthening, petroleum downstream sector deregulation, foreign exchange regime liberalisation, and revenue optimisation efforts.

While stressing that the National Integrated Infrastructure Master Plan (2020 to 2043) remains the cornerstone of Nigeria’s infrastructure development agenda, he emphasised the importance of public-private partnerships in bridging the infrastructure gap and driving economic growth.

The Nigerian leader underscored the need for swift action on Public-Private Partnership projects, stressing that they must move from planning to execution quickly. He urged that the projects emerging from the summit should not be delayed or stuck in bureaucracy, assuring that his administration would fast-track approvals for viable projects and ensure inter-agency coordination to facilitate swift implementation.

Tinubu noted that Nigerians prioritise tangible results, such as reliable power, good roads, clean water, quality healthcare, and education. He concluded by calling for collective action, stating that Nigeria has the potential but needs a unified purpose and decisive action. He challenged the summit to focus on delivering concrete results, signing deals, and driving progress, rather than just making speeches.

True to this, the president has empowered the Concession Regulatory Commission to implement a more efficient and better streamlined Public-Private Partnership project delivery process by approving PPP thresholds for ministries, departments, and agencies.

The decision marks a departure from the longstanding requirement that all PPP projects, regardless of size, must go through the Federal Executive Council for approval.

A statement by the Acting Head of Media and Publicity at the ICRC, Ifeanyi Nwoko, confirmed that the policy of decentralisation is expected to unlock private sector-led investments in underserved sectors, including health, education, agriculture, and housing.

“Under the new directive, PPP projects valued below N10bn for parastatals/agencies and N20bn for ministries will now be approved by respective project approval boards that will be constituted under ICRC guidelines and regulations.

“This approval is a game-changer. We now have a system that recognises the unique scale of smaller, high-impact projects that were previously delayed by bureaucracy. We are now looking forward to PPP investments in projects like rural diagnostic centres, classroom blocks, student hostels, and affordable housing,” the statement read.

The decentralised model is also designed to ensure faster turnaround time for project approvals, eliminate unnecessary bottlenecks, and create a scale-sensitive pathway for attracting targeted capital inflows into key infrastructure segments.

In their separate goodwill messages, top officials from prominent financial institutions, including Zitto Alfayo, Director & Global Head, Project Preparation, Afreximbank; Solomon Quaynor, African Development Bank Vice-President for Private Sector, Infrastructure & Industrialisation, AfDB; and Dahlia Khalifa, Regional Director, Central Africa & Anglophone West Africa at the International Finance Corporation, expressed unanimous support for Nigeria as a prime investment destination. They assured investors that the country’s updated Public-Private Partnership framework provides a more secure and appealing environment for sustainable investments.

One key takeaway from the summit is that unlocking Nigeria’s infrastructure potential through PPPs will require an ecosystem approach, anchored on policy coherence, institutional capability, financial innovation, and inclusive stakeholder engagement.

This, according to experts, will not only attract investments but also ensure that projects are sustainable, efficient, and beneficial to all Nigerians. They emphasised that a holistic approach is necessary to address the country’s infrastructure gaps and achieve meaningful development through Public-Private Partnerships.

They maintained that by adopting this ecosystem approach, Nigeria can unlock its infrastructure potential and achieve sustainable development through PPPs.

It is well known that subnationals play a vital role in ensuring smooth PPP execution, especially for projects that involve multiple states or regions.

Governors promise decentralised infrastructure delivery

Some sub-nationals who featured in the first panel session titled ‘Leveraging PPPs for Infrastructure Delivery in Nigeria: Opportunities and Potentials’ and moderated by the Chief Executive Officer of Agon Continental Limited and Board Member of the Nigerian Economic Summit Group, Nnanna Ude, underscored the potential of Public-Private Partnerships in driving growth and addressing development challenges.

In his intervention, Cross River Governor Senator Bassey Otu underscored the potential of PPPs to transform Nigeria’s infrastructure landscape. He stated that PPPs can tap into private sector resources and expertise to deliver essential infrastructure projects, promote economic growth, and improve living standards.

Speaking on the $3.5bn Bakassi Deep Seaport, Governor Otu highlighted the need for the project, citing increasing port congestion and Nigeria’s aspiration to become a trans-shipment hub for sub-Saharan Africa.

“The development of the Bakassi Deep Seaport is imperative to increase port capacity in the country and ease the pressure on existing ports.

“Most of the subnationals we have today are doing their very best to key into different sectors, taking their complementary advantage into consideration,” he stated.

In the same vein, Governor Lucky Aiyedatiwa of Ondo State listed the immense benefits of PPPs to include infrastructure development, increased efficiency, job creation, economic growth, and capacity building.

At the Ondo Seaport, the Governor said the $1.3 bn multipurpose project would transform the state’s economy, create thousands of jobs, and attract investments, while also serving as a catalyst for industrialisation and economic growth in the region.

This, he stressed, would increase the state’s revenue base and improve the standard of living for its citizens.

“Our administration recognises the potential of Public-Private Partnerships in driving growth and addressing development challenges, with a focus on enhancing public service delivery. We remain committed to fostering and expanding these collaborations.

“For us, we have moved past so many stages. We just need a few technical amendments between the ICRC and the Ministry of Marine and Blue Economy. As I am sitting here, I have letters of invitation to come to visit two of our investors who are keenly ready to move in as soon as that area is amended.

“We are ready. I believe our own deep-sea port is a unique one. For the modern vessels, a depth required is about 16.5 metres; we have a natural 18 metres already without being dredged.

“But the beauty of it is that we still need more ports in Nigeria. In fact, every state even needs more than one port, just like we have in Lagos with Apapa, Tin Can, and Lekki Deep Sea Ports, yet we are having congestion.

“It’s not just about vessels bringing in products only. We have a lot of products we are to ship out of Nigeria. Don’t forget that Ondo State is a leading cocoa-producing state in Nigeria.”

After robust discussions and strategic engagements, the summit resolved that, given the persistent fiscal constraints in the public sector, the Public-Private Partnership model remains an indispensable pathway for delivering public infrastructure and services in Nigeria.

On Project Suitability and Research, it resolved that while PPPs present a viable model for infrastructure development, not all projects are inherently suited to the structure.

“It is therefore imperative to invest in research and development to delineate the boundaries of PPP applicability and explore how to adapt models to accommodate context-specific realities,” the document read.

While noting that effective stakeholder management is fundamental to the success of PPP projects, the communique pointed out that a clear definition and understanding of roles, responsibilities, and interdependencies among stakeholders must be institutionalised.

It noted further that in the pursuit of ease of doing business, there is a need to prevent micro-level inefficiencies from escalating into macro-level obstacles, even as it called on regulators to continuously self-assess to ensure they remain facilitators rather than impediments to project execution.

The communique also resolved that “regulators must continuously self-assess to ensure they remain facilitators rather than impediments to project execution. Early identification and resolution of regulatory bottlenecks are essential.

“The government must enhance its role in project preparation, transaction advisory, and facilitation, thereby allowing private sector participants to concentrate on core delivery, efficiency, and innovation.

“The government should explore asset recycling as a credible strategy to unlock value from existing infrastructure, thereby multiplying the public benefit and improving long-term fiscal sustainability.

“The most effective mechanism for mobilising capital for infrastructure remains through blended financing, leveraging a mix of public funds, private capital, development finance, and risk mitigation tools.”

Furthermore, the Summit called on Nigeria to significantly increase its mini-grid capacity to improve energy access and support decentralised power solutions and tasked the National Assembly with fast-tracking the approval of the Federal Roads Authority Bill and the National Road Fund Bill to provide sustainable funding for road infrastructure.

PPP contracts, the communique pointed out, need to be refined to be bankable without relying heavily on sovereign guarantees.

The event also emphasised the need for subnational entities to be actively involved in PPP projects, especially those spanning multiple states or regions.

The communique also called on investment firms to create innovative financial products for retail investors to boost infrastructure funding, adding that the rail sector requires urgent attention and should be prioritised in the PPP infrastructure strategy. As the echoes of the 2025 PPP Summit linger, they serve not just as memories but as a powerful reminder of what collaboration, innovation, and collective ambition can achieve when aligned toward a national purpose. But as with all ambitious declarations, the true test lies ahead; the devil is in the implementation.