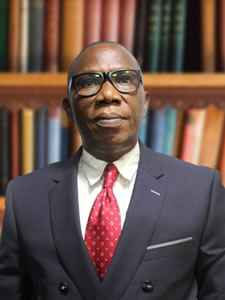

The Managing Director and Chief Executive Officer of TrustFund Pensions Limited, Mr Uche Ihechere, has said that inflationary pressures and naira depreciation are undermining the real value of pension returns, despite improved performance across the industry.

Ihechere, who spoke to journalists after the company’s Annual General Meeting held in Abuja on Saturday, stated that although TrustFund posted strong growth in key metrics in 2024, the returns fail to match up when adjusted for inflation.

“In terms of returns, yes, positive returns in the gross sense,” he said. “But if you now benchmark it to inflation, it’s negative returns.”

He added that, “The industry has continued to grow, but it’s not growing as fast as inflation. So, in terms of real returns on investment, we are lagging.”

Ihechere revealed that TrustFund Pensions recorded a 20 per cent increase in assets under management and a 34 per cent growth in profit before tax for the year ended December 31, 2024.

He attributed the growth to sound investment decisions, operational efficiency, and an active board of directors. “In all performance indices, we were up by double digits, higher than double digits. This is not a result of a PFA that is sleeping on its duties. This is a product of management that is alive to its responsibilities,” he said.

Despite these gains, the TrustFund boss decried the shortage of viable investment options capable of delivering inflation-beating returns. He said the existing investment pipeline was narrow and called for a more robust legal and regulatory framework to support infrastructure-backed instruments and other growth-oriented assets.

“We are not deal creators. We invest in deals,” he said. “And so those who create the deals… the deal pipeline is not expanding. The areas where investment can deliver higher returns are not coming up.”

Ihechere also backed the proposed N758bn bond by the Federal Government to clear outstanding pension arrears, describing it as a clear indication of renewed commitment to retirees’ welfare.

While commending the efforts of the National Pension Commission, Ihechere noted that the regulator must go beyond compliance enforcement and focus more on market expansion.

He disclosed that fewer than 11 million Nigerians are currently enrolled in the pension scheme out of a population exceeding 230 million, adding that more needed to be done to increase enrolment from both the public and private sectors.

Also speaking, the Chief Executive Officer of Chapel Hill Denham, Mr Bolaji Balogun, said that strong investment performance is the only way pension fund managers can effectively protect contributors’ savings from inflation.

Balogun noted that the firm had delivered solid returns in 2024 and paid its strongest-ever dividend, supported by a well-capitalised business.

He explained that outperforming inflation requires increased investments in equities, infrastructure, and alternatives, rather than relying heavily on fixed-income instruments.

Balogun also stressed that growing the pension sector would depend largely on improved financial performance and greater public education about pensions.

President of the Nigeria Labour Congress, Mr Joe Ajaero, criticised the Federal Government for undermining the pension system and workers’ welfare by failing to uphold its responsibilities and breaching existing laws.

Ajaero criticised the government for accessing pension and social security funds that do not belong to it, stating, “Government is using workers’ money… borrowing from there is illegal.”

He also raised concerns over the handling of social security contributions, particularly the Employees’ Compensation Fund under the Nigeria Social Insurance Trust Fund.

Ajaero decried the government’s collection of 50 per cent of contributions from the Employees’ Compensation Fund, calling it an “illegality,” and questioned the logic of treating accident compensation funds as public revenue.

“The government is collecting 50 per cent of that fund as revenue. Where else does that happen?” he asked. He accused the government of failing to constitute the PENCOM board for nearly four years, despite the law mandating representation from both labour and employers.

Ajaero acknowledged that the transition to the contributory pension scheme was a step forward but said many challenges remain, especially with remittance compliance.

“Pension arrears and delays are still a concern for many retirees, and government at all levels must be held accountable,” he added. Ajaero emphasised the urgent need to strengthen the governance structure of the National Pension Commission.

On the minimum wage and worker welfare, the NLC president argued that inflation and rising tariffs had already eroded the impact of any wage award. Despite these concerns, Ajaero expressed hope that continued dialogue between labour and the government would yield meaningful reforms.