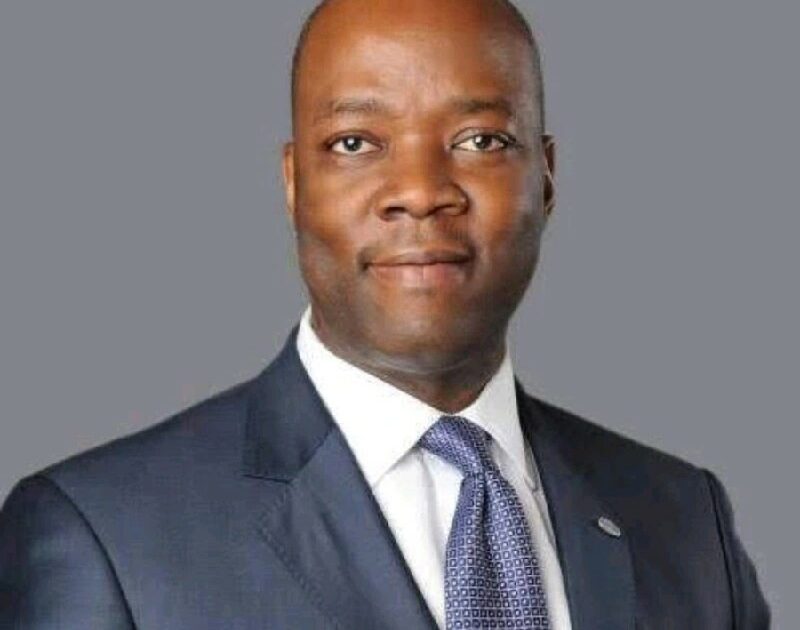

The immediate past Managing Director of Ecobank Nigeria, Patrick Akinwuntan, has advised young professionals to prioritise early savings and retirement planning as a strategy for long-term financial stability.

Speaking at the Lagos Archdiocesan Young Catholic Professionals Day 2025 recently, Akinwuntan said youths must distinguish between consumption and investment and cultivate a habit of acquiring value-adding assets.

“Save 70 per cent of what you earn,” he said while stressing the need for financial discipline and early preparation for retirement. He warned against living beyond one’s means, such as buying expensive vehicles or gadgets that offer little functional value.

He also encouraged youths not to fear failure, but to learn from it.

“It is not about falling, but about what happens afterwards. A can-do spirit does not mean you’re right all the time,” he said.

Themed Self-growth and financial freedom: lessons from disruptors, the event featured a keynote address by Akinwuntan and a panel session comprising professionals from various sectors. Panellists included the Managing Director/Chief Executive Officer of Techno Oil, Nkechi Obi; financial expert and founder of OO Value Investment, Oghogho Osula; co-founder of Vpay, Chibuzo Ike; founder of Market Doctors Nigeria, Yetunde Ayo-Oyalowo; and communications strategist, Harrison Obiefule.

Akinwuntan described self-growth as “the desire to become a better version of oneself”, and advised professionals to learn, unlearn and relearn. He noted that disruptors are those who identify and solve problems for the common good while creating value for themselves and others.

“Youths are already leaders. Leadership requires courage to go forward even when you are afraid,” he added. He also emphasised the importance of integrity and mentoring, urging participants to “learn from other people’s mistakes and successes.”